- IT Consulting

- Technology

- IT Planning

- Branch Connectivity

- IT Documentation

- Server Maintenance

- Firewall Solutions

- VPN Access

- Patch Management

- Data Backup

- Remote Monitoring

- Email Solutions

- Network Cabling

- Virtual Server Solutions

- Anti-Virus/Spam Protection

- Workstation Solutions

- Core Support Solutions

- IT Personnel Recruiting/Training

- Telephone Systems

- Compliance

- Technology

- IT Audit

- E-Branch

- About Us

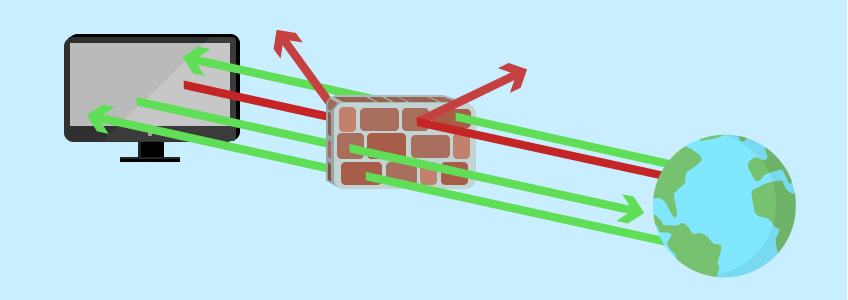

The Layered Security Approach

We take a layered approach to securing your credit union's network. No single solution can protect you from all avenues that a malicious user could use to gain access to your credit union's information systems, but, by combining hardware, software, and good user policies, your systems and data can be well protected. Hardware firewalls conceal your credit union's network from outside connections, while still allowing your employees to browse the Web and use applications. Software configuration is one of the key elements in maintaining a secure network. By keeping these configurations up-to-date through patches and hot-fixes, standard hacker attacks are avoided -- not to mention preventing performance problems and other common issues!

Internet Content Filtering

Hardware firewalls can provide content filtering that shields your users from unacceptable sites. Most firewalls are easily customized, can restrict access by category or time of day, and can allow site overrides with administrative credentials.

What should you know about your firewall?

Monitoring and managed firewall services

- They do not want you to have any control or knowledge of the firewall. They typically will not give you documentation of the setup or configuration of your firewall.

Your firewall and your core provider

- No matter what the core provider tells you, even if they are providing your firewall service or hardware firewall, you need a firewall between your credit union's network and your core provider. If you do not have one between them and you, your credit union is at risk to all the vulnerabilities of the core provider and they are a bigger target than you are thus more likely to be targeted for attack.

- You only need to open a few ports for the core services.

- The core providers are also notoriously lackadaisical about keeping the firewall firmware and software updated.

- They are also not the greatest at configuring the firewall to maximize the utilization of all the firewalls capabilities.

- It will be difficult for you to make any of your own changes.

- They will not give you documentation of the setup or configuration of your firewall.

Your firewall and the local IT or computer company

- Credit unions are generally not their focus.

- Typically they do not make use of all the layers of protection that a firewall has to offer. When we do audits, we regularly encounter firewalls that are improperly configured.

- They usually never document and do not approach the process strategically. They want to sell you a firewall and put it in and that is it.

If you would like to know more about firewalls and how you can have control and save money call:

Paul Elder 614-848-5400 ext 121 or email Paul Elder

Larry Krietemeyer 614-848-5400 ext 143 or email Larry Krietemeyer